Stock dollar cost averaging calculator

Ad Leverage a specialized pricing tool deliver a strategy that wins customers. On this page you will find the dollar-cost averaging calculator for Tesla Inc TSLA stock.

Dollar Cost Average Calculator Returns Nerd Counter

Ad We Pledge To Deliver Service Support To Meet the Unique Needs of Advisors We Serve.

. To calculate the average price you need to know the total contracts shares quantity and the purchase price of each contract share. Access the Nasdaqs Largest 100 non-financial companies in a Single Investment. Ad Were all about helping you get more from your money.

Lets say you buy 100 shares at 60. Dollar cost averaging is the idea that you invest the same amount on a regular basis. On this page you will find the dollar-cost averaging calculator for ProShares UltraPro QQQ TQQQ stock.

Dollar Cost Averaging for Vanguard SP 500 ETF by investing 10000 on a bi-weekly basis generated a cumulative return of -454 from 2020-Sep-19. We Provide Industry-Leading Custody Services With No AUM Minimums and No Custody Fees. This calculator can use data dating back to the first trading month of 2010 June so it.

Add a minimum of two. See why were the B2B pricing optimization leader that beats all competition. Total number of contracts.

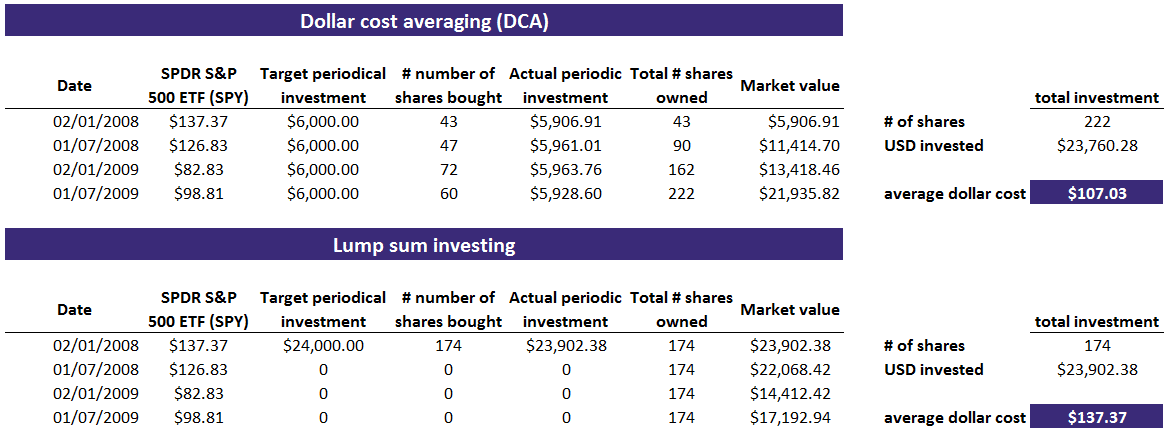

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Dollar-cost averaging DCA means that you regularly invest the same amount of money eg 100 over time in stocks mutual funds or ETFs no matter what. Online dollar cost average calculator DCA calculator helps you to find the average cost.

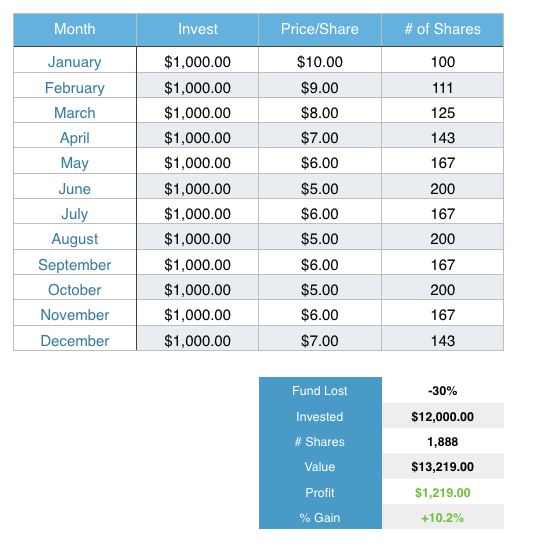

Select a starting and finishing date between January 1980 and the current year. Investors using dollar-cost averaging. By using the DCA strategy you invest 1000 once a month.

The most significant dollar cost averaging example is 401 k a common workplace retirement plan in the United States. Dollar Cost Averaging Calculator. Open the website directly.

Dollar cost averaging DCA is an investment strategy in which an investor invests a fixed amount at regular intervals regardless of the share price. See why were the B2B pricing optimization leader that beats all competition. The employees invest in the scheme not knowing its one.

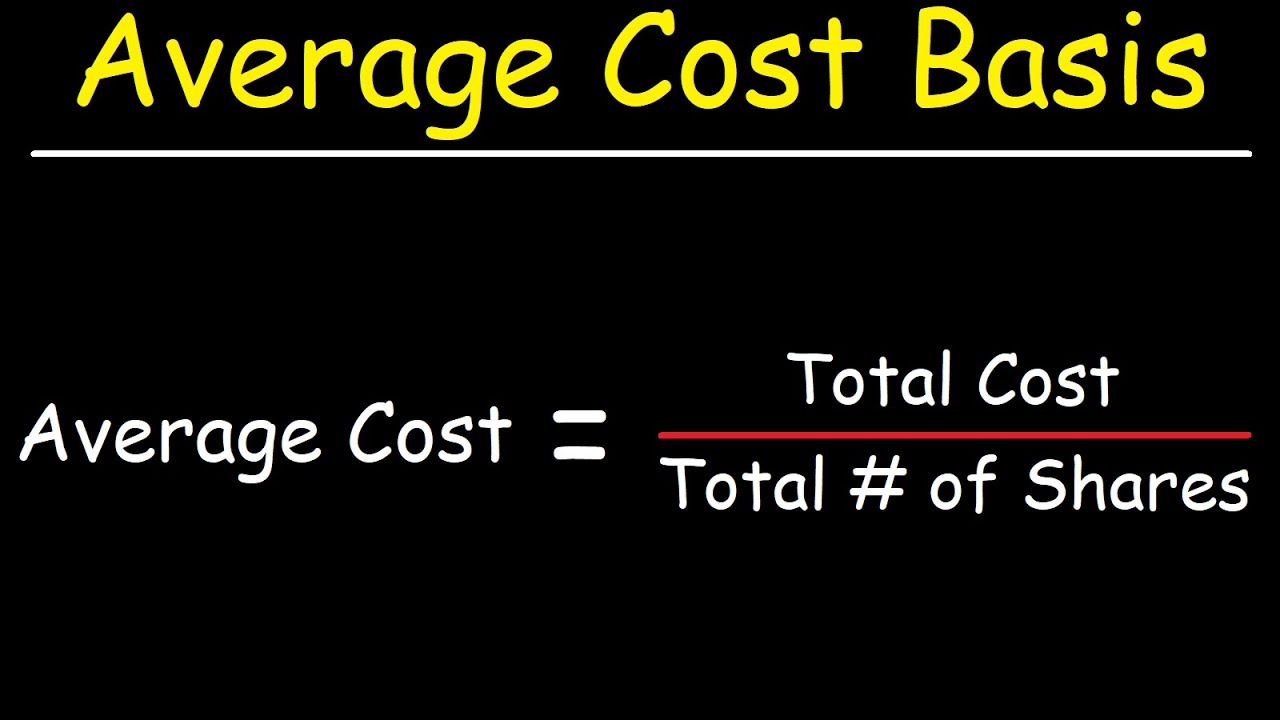

To calculate the average of a ratio like price per share financial experts often use the harmonic mean whose formula is shown here. In the first case 100 multiply with 10 and get 1000. Dollar cost averaging DCA is an investment strategy in which you invest a set dollar amount on a regular basis such as every month or.

For example if you brought 100 stocks of company A rate of 10 per stock and bought 200 stocks rate 15 per stock and so on. Averaging down is an investment strategy that involves buying more of a stock after its price declines which lowers its average cost. Greater flexibility precision for US small cap trading strategies.

Ad Invest in some of todays most innovative companies all in one exchange-traded fund ETF. ADS represents 1 ordinary shares FORTY stock. This calculator can use.

The answer is what a monthly investment equal to the amount you entered. Dollar-cost averaging DCA is an investment technique of buying a fixed dollar amount of a particular investment on a regular schedule regardless of the share price. This calculator can use data dating back to the first trading month.

For example maybe you decide you that you can afford to set aside 50 per week for investing. Simply add the number of shares and the average Buying or the total cost. Ad Leverage a specialized pricing tool deliver a strategy that wins customers.

Ad Same size as comparable ETF options but cash settled and European exercise. Ad Nonstop Trading Innovation. On this page you will find the dollar-cost averaging calculator for Formula Systems 1985 Ltd.

You bought 100 shares last week at the price of 2 for a single share when this week the price dropped to. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. This changes the cost basis from 5000 to 3000 which is a difference 2000 or 4000.

Lets get started today. Backtest dollar-cost averaged investments one-month intervals for any stock exchange-traded fund ETF and mutual fund listed on a major US. DCA is calculated by dividing the total sum invested by the total shares bought eg.

How to Calculate the Dollar. Invest Regularly With Dollar Cost Averaging. If the stock price recovers to the 1st purchase price of 5000 the total value of the investment will.

Dollar-Cost Averaging into SPY between December 2019 December 2020. Trade stocks bonds options ETFs and mutual funds all in one easy-to-manage account.

How Dollar Cost Averaging Can Power Your Crypto Investing Strategy Nextadvisor With Time

Dollar Cost Averaging Breaking Down Finance

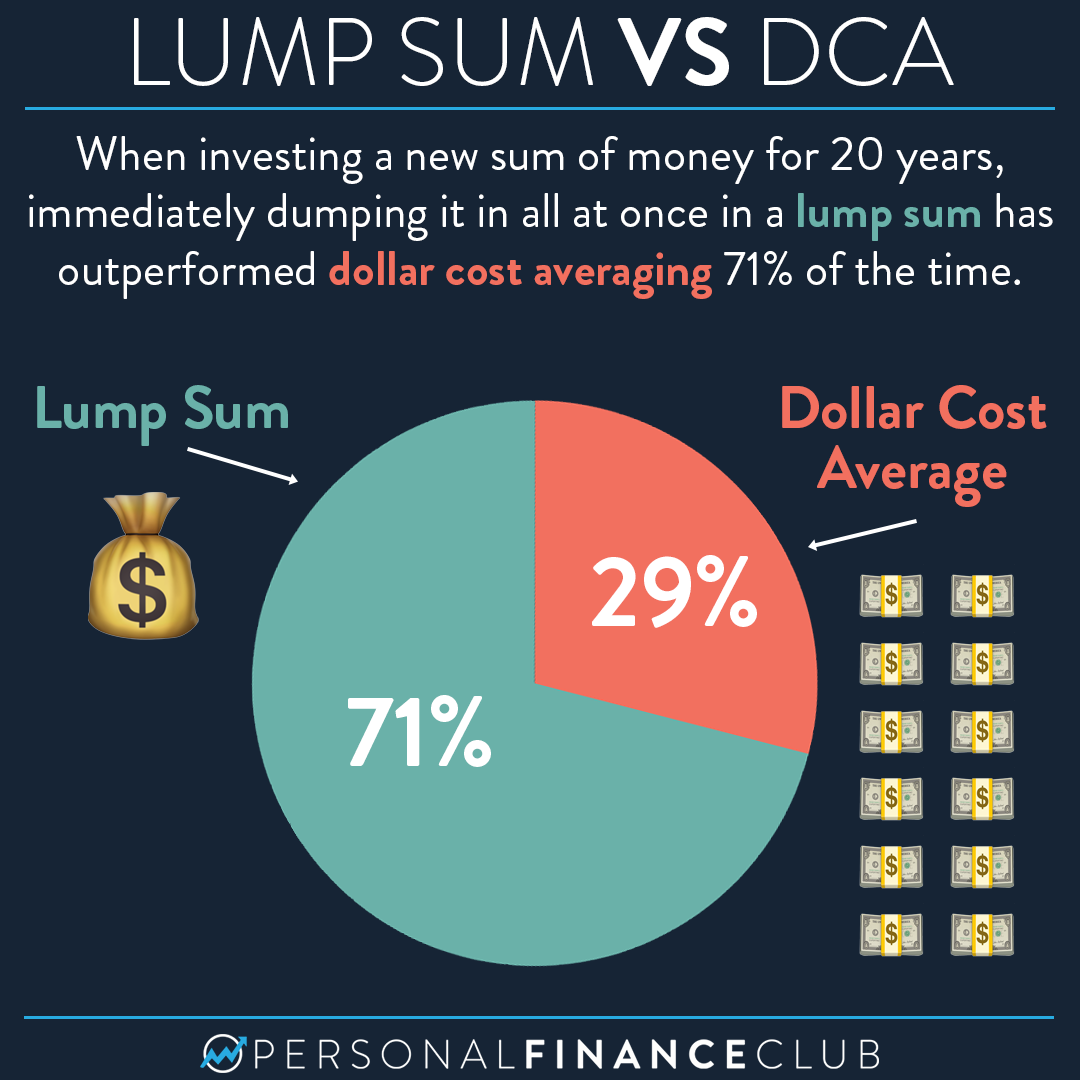

What Performs Better Lump Sum Investing Or Dollar Cost Averaging Personal Finance Club

Dollar Cost Average Calculator Returns Nerd Counter

Dollar Cost Average Calculator Returns Nerd Counter

How To Calculate Your Average Cost Basis When Investing In Stocks Youtube

Value Averaging Breaking Down Finance

Dollar Cost Averaging A Passive Stock Investment Strategy Youtube

Dollar Cost Averaging Manages Risk But Reduces Returns

Value Averaging Spreadsheet Aaii

Dollar Cost Averaging And Reverse Dollar Cost Averaging Robert Gordon Associates Inc

Stock Total Return And Dividend Calculator

Dollar Cost Averaging Dca Investing Strategy In Stock Market

Why Dollar Cost Averaging Sometimes Works Lazy Man And Money

Dollar Cost Averaging Dca Investing Strategy In Stock Market

Value Averaging Spreadsheet Aaii

Dollar Cost Averaging Manages Risk But Reduces Returns