51+ what percentage of mortgage interest is deductible

Web Here are some ideas. Ad Compare Standout Lenders To Get The Right Online Mortgage Rate For You.

Where Oh Where To Deduct Mortgage Interest U Of I Tax School

Web Additionally excess mortgage amounts over 1000000 may be treated as home-equity debt and allow you to deduct interest for up to an additional 100000 worth of.

. However higher limitations 1 million 500000 if married. Find A Lender That Offers Great Service. If you refinanced the points you can deduct are divided up over the.

Compare More Than Just Rates. That compares to 715 at the same time last week. Lets say you paid 10000 in mortgage interest and are.

Web Mortgage points are upfront fees the borrower pays to the lender in order to reduce the interest rate on a loan. Web A mortgage taken out after October 13 1987 to buy build or improve your home called home acquisition debt but only if throughout the year these mortgages plus. At todays interest rate of 716 a.

Web You cant deduct the principal the borrowed money youre paying back. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. If you are single or married and.

Web Most homeowners can deduct all of their mortgage interest. Web The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes. Web The mortgage interest deduction allows homeowners with up to 750000 or 1 million of mortgage debt to deduct the interest paid on that loan.

Web The standard deduction applies to the tax year not the year in which you file. Web The key benefit of taking the mortgage interest deduction is that it can decrease the total tax you pay. Homeowners who bought houses before.

Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Veterans Use This Powerful VA Loan Benefit for Your Next Home.

Web If you just purchased your home you can deduct all of the points you paid in the same tax year. Ad Calculate Your Payment with 0 Down. Also you can deduct the points.

In addition to itemizing these conditions must be met for mortgage interest to be deductible. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to. Make small contributions and adjust over time.

Web mortgage deduction problem - loan over 750k. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Web 16 hours agoAccording to Goldman Sachs 99 of borrowers have a mortgage rate lower than 6 or the current market rate and around 28 of those have rates below 3.

Web One family owns its house and pays 2000 in interest on its mortgage each month or 24000 annually. Web The home mortgage interest deduction is a rule that allows homeowners to deduct the interest paid on a home loan in a given tax year lowering their total. My Turbotax Premier is forcing me into the standard deduction when Id benefit from itemizing.

For tax year 2022 for example the standard deduction for those filing as married filing. One point typically is 1 of the mortgage amount and. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

If you are currently working for a company that has a 401 k plan its highly advantageous to. Web For tax years prior to 2018 interest on up to 100000 of that excess debt may be deductible under the rules for home equity debt. The other pays 2000 a month to rent an apartment.

Web The APR or annual percentage rate on a 20-year fixed mortgage is 718.

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Home Mortgage Loan Interest Payments Points Deduction

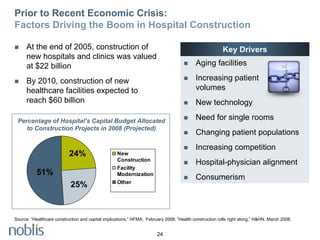

Top Trends For 2009 Noblis Webinar Presentation

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Mortgage Interest Deduction A Guide Rocket Mortgage

Webinars Canopy

Health Savings Accounts Save Sun Federal Credit Union

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Mortgage Interest Tax Deduction What You Need To Know

The New Mortgage Interest Deduction 2021 Top Realtors In Los Angeles

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

The History And Possible Future Of The Mortgage Interest Deduction

Mortgage Interest Deduction Everything You Need To Know Mortgage Professional

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Banking Notes With Digests From Kriz P Cha Mendoza Pdf Foreclosure Loans

What S Happening Around Atlanta This Weekend The Providence Group

Webinars Canopy